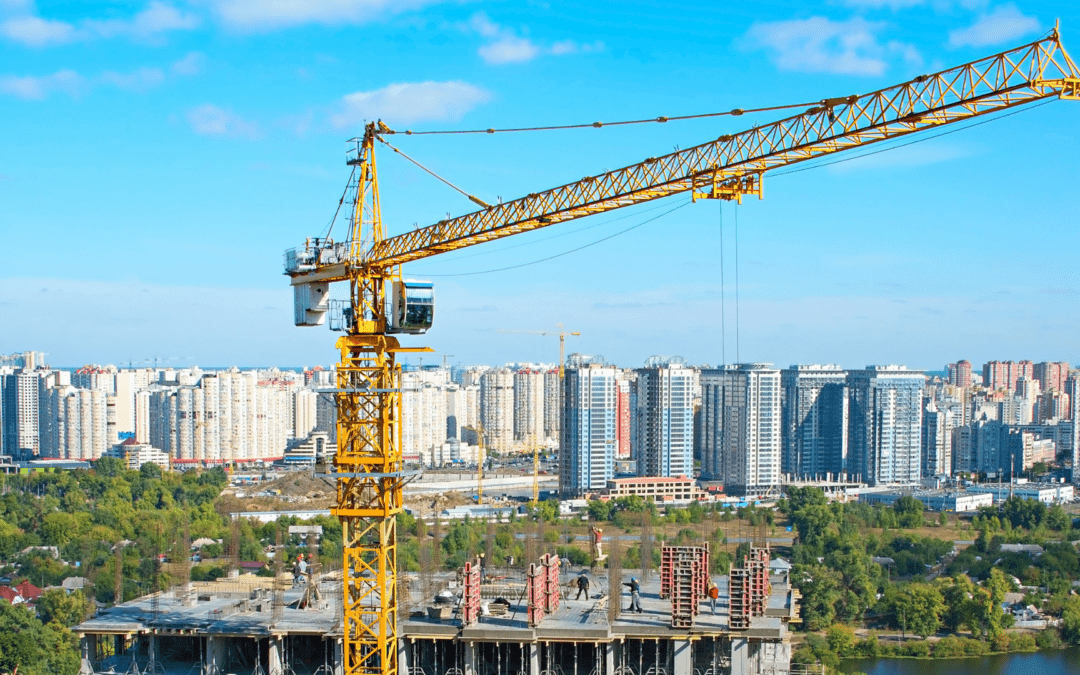

We continue our series on Contractors All Risk (CAR) Insurance to explain more about the Benefits and Limitation of Contractors All Risk Insurance. A good insurance broker such as Beneple who specliaise in not only group medical insurance but also general insurance should be able to assist with this also. Further information on Contractors All Risk (CAR) Insurance can also be found in part 1 of of our blog series here.

Benefits of Contractors All Risk (CAR) Insurance

Having Contractors All Risk (CAR) insurance offers several benefits for all parties involved in construction projects. These benefits include:

1. Protection against financial losses: CAR insurance protects contractors, builders, developers, and owners from unexpected financial losses due to unforeseen events. Whether it’s property damage, theft, or liability claims, CAR insurance ensures that you are financially secure.

2. Assistance with repairs or replacement: In case of physical damage to the property, CAR insurance provides assistance with repairs or replacement of the damaged property. This helps minimise the financial burden on the insured party and ensures that the construction project can continue smoothly.

3. Coverage for third-party liabilities: CAR insurance includes coverage for third-party liabilities, such as bodily injury or property damage caused to workers or individuals not directly involved in the project. This protects the insured party from potential legal and financial repercussions.

4. Flexibility and customization: CAR insurance policies can be tailored to meet the specific needs of different construction projects. Whether it’s a small-scale residential project or a large-scale infrastructure development, the coverage can be customised accordingly.

5. Peace of mind: By having CAR insurance in place, all parties involved in the construction project can have peace of mind knowing that they are protected against potential risks and liabilities. This allows them to focus on the project without constantly worrying about unforeseen events.

Limitations of Contractors All Risk (CAR) Insurance

While Contractors All Risk (CAR) insurance provides valuable coverage, it’s important to be aware of its limitations. Here are some common limitations associated with CAR insurance:

1. Pre-existing conditions: CAR insurance typically does not cover damages or losses that existed prior to the policy inception. It is essential to disclose any pre-existing conditions or known risks to the insurer to ensure proper coverage.

2. Maintenance and wear and tear: CAR insurance does not cover damages resulting from normal wear and tear or lack of maintenance. It is the responsibility of the insured party to properly maintain the property to prevent such damages.

3. Consequential losses: CAR insurance may not cover consequential losses that occur as a result of delays or disruptions caused by the insured party. This includes financial losses due to project delays or loss of business opportunities.

4. Professional negligence: CAR insurance does not cover losses or liabilities arising from professional negligence or design errors. Professional indemnity insurance is typically required to cover such risks.

5. Specific exclusions: Each CAR insurance policy may have specific exclusions and limitations that need to be carefully reviewed. It is crucial to understand the policy terms and conditions to ensure proper coverage.

Frequently Asked Questions (FAQs)

Is CAR insurance mandatory for construction projects?

CAR insurance is not mandatory by law in all jurisdictions. However, it is highly recommended for all parties involved in construction projects due to the inherent risks and potential financial losses.

How much does CAR insurance cost?

The cost of CAR insurance depends on various factors, including the type and scale of the project, the construction materials used, the location, and the coverage limits required. It is best to consult with insurance providers to get accurate cost estimates based on the specific project details.

Can CAR insurance be purchased during an ongoing construction project?

Yes, CAR insurance can be purchased during an ongoing construction project. However, it is advisable to obtain coverage before the start of the project to ensure comprehensive protection from the beginning.

Does CAR insurance cover delays in construction projects?

CAR insurance typically does not cover financial losses resulting from project delays. However, it may cover delays caused by physical damage or other covered perils that result in additional costs.

Can CAR insurance be extended to cover existing structures during renovation projects?

Yes, CAR insurance can be extended to cover existing structures during renovation projects. This ensures that both the existing structure and the construction work are adequately protected.

Conclusion

Contractors All Risk (CAR) insurance is an essential tool for managing risks in construction and engineering projects. It provides coverage for physical damage, loss, and third-party liabilities, offering financial protection to contractors, builders, developers, and other parties involved. By understanding the purpose, coverage, benefits, and limitations of CAR insurance, all stakeholders can make informed decisions and ensure adequate risk management for their construction projects. Consultation with insurance professionals and a careful review of policy terms and conditions are crucial steps in obtaining the most suitable CAR insurance coverage.