What is Cyber Security Insurance?

Cyber security insurance, sometimes referred to as cyber insurance or cyber liability insurance, is a contract that a company can buy to protect itself against cyberattacks or data breaches. It may not stop the attack from happening but it will help greatly reduce the financial risks associated with a cyberattack by transferring most of the risk to an insurer.

Last year alone Cyber Security Ventures Research estimated that cyber attacks would cost the global economy more than USD $6 Trillion (yes that’s trillion with a T). The recent Covid-19 pandemic, people working remotely, and the rapid growth in the digital economy have seen a meteoric rise in cybercrime, and experts estimate the average breach costing firms $3.6m.

What are the Most Common Types of Cyber Attacks?

There are multiple types of cyber attacks and the most common include:

- Phishing attacks

- Password hacks

- Malware/ransomware

- Identity theft

- Fake president emails and many, many more

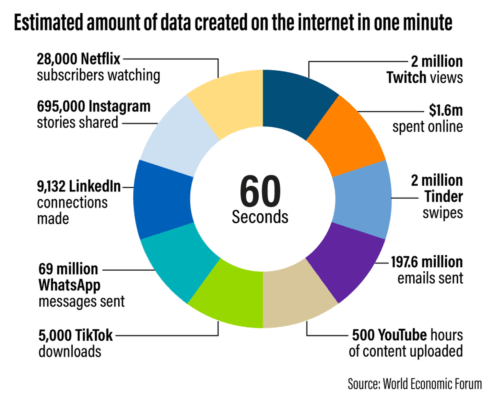

With digital consumption at a record high and many businesses unable to function without their operating systems, just about every major corporation on the planet has at one time or another had its systems compromised or have been attempted to be breached by hackers.

Cyber insurance, whilst still quite new in the insurance world, has its origins in professional indemnity (PI) insurance, a separate form of insurance that protects against faults or negligence in the services a company provides.

Whilst some cyber insurance policies include specific provisions for professional indemnity insurance, most providers sell these as separate and distinct policies. Professional Indemnity insurance does not cover the loss of third-party data and often PI policies will have a cyber exclusion written into them. Therefore businesses that require cyber protection need to purchase a separate cyber insurance policy that includes this.

Why do you need Cyber Security Insurance?

Put simply, many businesses are unable to function or run without access to their online systems. The loss, theft, or compromise of data can have a huge impact on a business, including financial loss, reputational damage, loss of customers, damages to pay out, and ultimately can end up closing a business. For many firms, a cyber attack can be catastrophic, and not all firms have the luxury of huge cash reserves and so mitigating against such risks is crucial.

There are various examples of how large corporations have had their systems breached, and shows the importance of cyber security. Sony’s PlayStation network was famously breached in 2011 by hackers and exposed personal data (referred to as personally identifiable information – PII) of 77 million PlayStation user accounts. The breach caused an outage for 23 days and prevented users from accessing the service and cost Sony over $171 million. If Sony, Portions of this cost could have been covered by a cyber insurance policy, but Sony did not have one in place. A court case ruled that Sony’s insurance policy covered damage to physical property only, leaving Sony to incur the full amount of costs related to cyber damages.

How do you get Cyber Security Insurance?

It is still a relatively ‘new’ market and therefore only a few insurers have the capability and the appetite to write this business. Insurers require a detailed proposal form to be completed and then a good broker will approach those specialist insurers who have capacity. Beneple has a specialist team of brokers who look after Cyber Security Insurance policies and you can get a quote here.

What does it cover?

Besides legal fees, fines and expenses, cyber insurance typically helps with:

- Crisis Management

- Notifying customers about a data breach

- Restoring personal identities of affected customers

- Recovering compromised data

- Repairing damaged computer systems

- Reputation damage limitation by employing specialist PR agencies

How much does Cyber Security Insurance cost?

The cost of cyber security varies hugely depending on the sector you are involved in, the size and nature of your business, security systems currently in place, and a huge number of other things.

What next?

Get in touch with the team at Beneple or a qualified insurance broker to discuss whether your business would benefit from cyber insurance and get a quote.